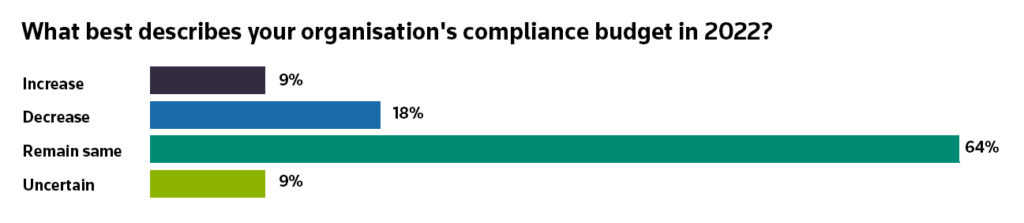

Two thirds of compliance teams will have to make do with a stable budget in 2022, despite the more challenging risk landscape, a Regulatory Intelligence poll has found. The live survey during a webinar on the outlook for the year ahead found that only 9% of compliance teams expect to see an increase in their budget this year.

For 18% of firms the news is even more bleak, with one in every five compliance teams expecting to see a reduction in their 2022 operating budget.

The webinar, which is available on-demand, assessed the “top ten” things that compliance officers will need to consider in 2022.

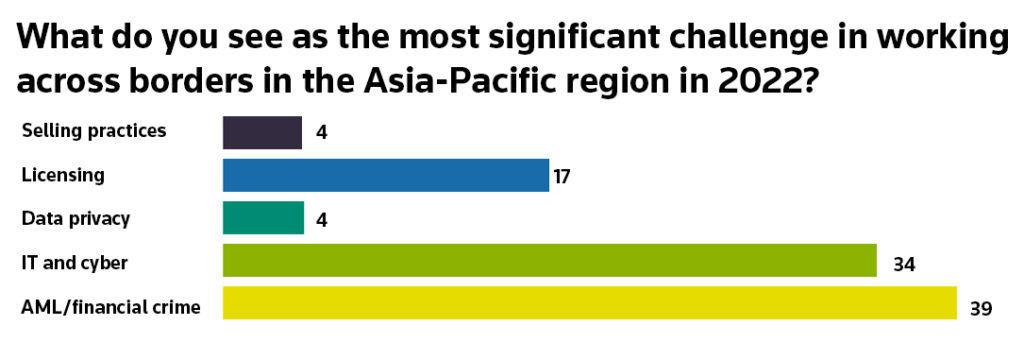

One third of respondents said their chief cross-border concern for the year head would be IT and cyber regulation. Licensing is also likely to be a top-tier challenge for 17% of firms that have a regional presence.

A new report from Deloitte found that regulators are grappling with continuing change and uncertainty. This is placing further pressure on regulatory agencies to deal with fragmentation, which requires more coordination and collaboration than ever before.

These pressures pose significant challenges for regulators, the regulated community, and, ever increasingly, the broader non-regulated ecosystems around the financial services industry.

“The Asia Pacific region continues to navigate its way to economic recovery despite these uncertainties. Although the region’s growth is leading the rest of the world, overall recovery has been uneven as a result of new COVID-19 variants,” said Mike Ritchie, Deloitte partner for risk advice.

“The evolving regulatory agenda in Asia-Pacific will continue to be complex and challenging, with authorities having to balance safeguarding stability with supporting the recovery while also keeping an eye out for social and economic inclusion, sustainability and digital transformation. As we emerge from the pandemic, there will still be much work to be done.”

About the author

Nathan Lynch is an experienced writer, public speaker, manager and technology enthusiast in the field of financial regulation and risk management. At Thomson Reuters, Nathan leads a team of experts who provide breaking news, deep analysis and practical guidance to risk practitioners in the global financial services sector.

Nathan manages Thomson Reuters’ award-winning Regulatory Intelligence team across the Asia-Pacific region, tracking developments in financial services law, regulation, financial crime and risk management.

Nathan has been involved in building innovative, tech-based businesses in the financial services “regtech” sector — including Complinet Australia and the Thomson Reuters Risk business.