Amidst shifting regulatory frameworks, organisations worldwide are experiencing a significant push for tax transparency. The increasing focus on digital transformation (DX) is the critical means to ensure real-time data reporting and investigation. But the impact goes far beyond delivering on compliance alone.

A new survey by Thomson Reuters shows that using digital transformation (DX) in tax reporting can provide many benefits for businesses. Six hundred and fifty professionals based in Australia, India, Japan, MENA, and Southeast Asia took part in the survey. The insights from decision makers, reveal that demonstrating transparency significantly boosts trust with regulators and tax authorities.

This unique situation has created a competitive space for corporations to be leaders in tax transparency. What is more, decision makers are showing significant interest in pursuing this opportunity.

Furthermore, the report, suggests that growing transparency measures work to drive positive company reputation. In effect, it offers more pathways for a company to demonstrate alignment with their Environmental, Social, and Governance (ESG) strategies.

DX boosts trust and transparency

Businesses are increasingly leveraging technological advancements. From artificial intelligence (AI) to machine learning and robotics, companies are transforming compliance operations with increasing levels of sophistication. This is not only essential for future-proofing a business. To comply with the global push for tax transparency in tax compliance and reporting, organisations are embracing DX.

Two in five decision makers surveyed (40%) said the global push for tax transparency has sped up their DX plans.

Improved reporting and investigation practices have not only led to greater tax transparency. They have also proven to be a powerful way to build rapport with regulatory bodies and nurture relationships.

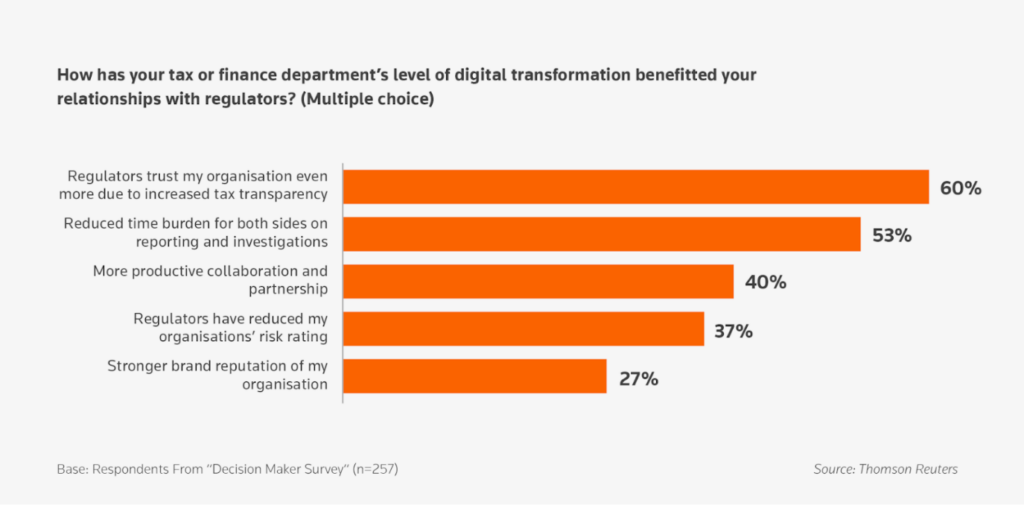

Three in five decision makers (60%) believe regulators place greater trust in their organisations, due to their efforts on tax transparency. Meanwhile, over half of decision makers surveyed (53%) said that the reduced time spent on reporting and investigations has benefited relationships.

Regulators see that organisations are reinforcing their dedication to compliance, by embracing DX and adopting purpose-built solutions.

The following graph breaks down the perceived benefits of digital transformation on relationships with regulators. Beyond trust building, it notes further key factors. These include a reduced time burden on both sides, more productive collaboration, a reduced risk rating and strong brand reputation.

The results of this increased trust offer considerable business potential. Investing in DX can position organisations at the forefront of tax compliance. It is a signal of a proactive approach towards transparency and responsible fiscal management.

Tax compliance builds company reputation

The success of a company and its reputation are inextricable. Tax compliance is no small factor of maintaining a positive image. Nearly three in five decision makers (56%) use improvements in their company’s reputation as a critical metric to gauge their success.

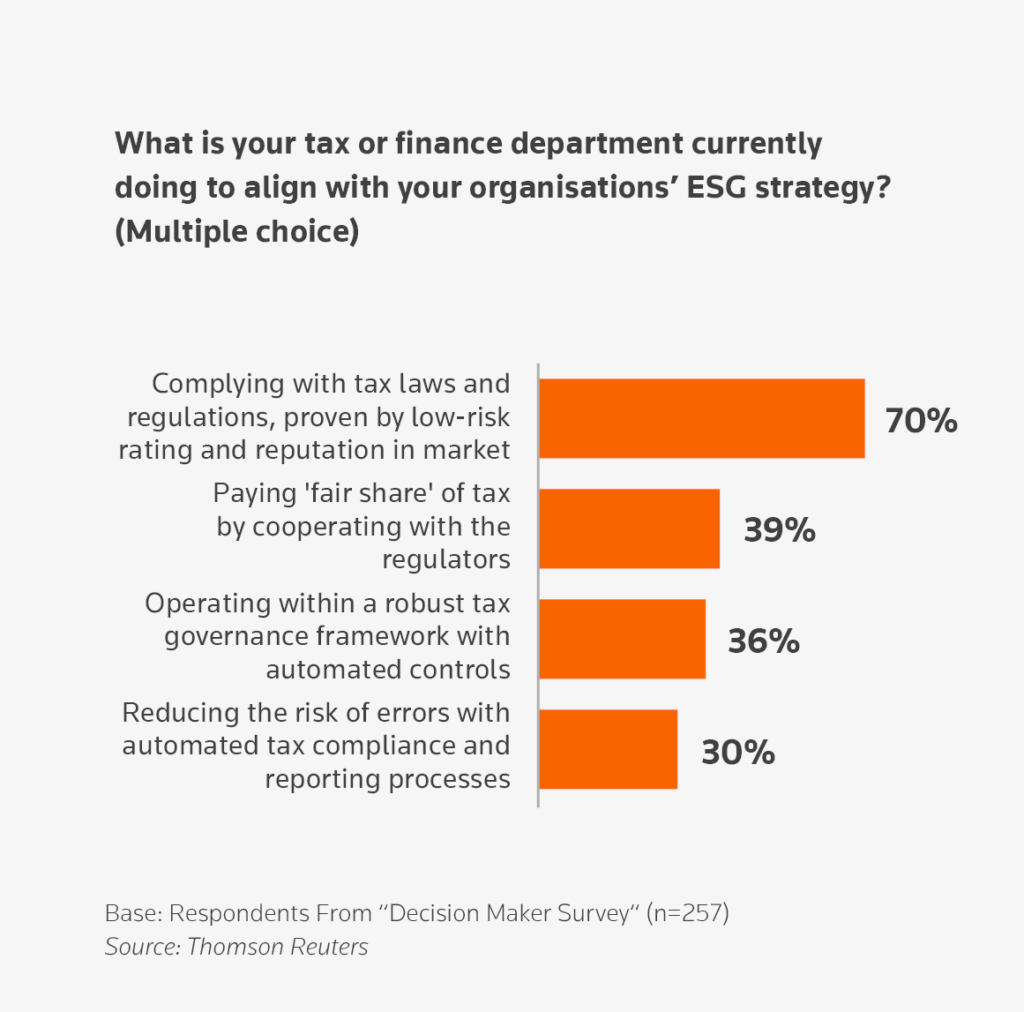

Most decision makers surveyed (70%) are complying with tax laws and regulations to align with their organisation’s ESG strategy. By maintaining a low-risk rating and positive company reputation, a business publicly demonstrates a commitment to responsible business practices. And of course, fiscal management.

Investing in DX today makes business sense

The benefits of streamlined on-time compliance rates alone prove the value of tax technology investment. Technology roadmaps should shape transparency-increasing measures reap the benefits of DX and boost company reputation while delivering on compliance. By consistently meeting compliance deadlines, organisations demonstrate their dedication to embracing technology for efficiency and accuracy.

But the global push for tax transparency has become a unique force in driving organisations to adopt digital transformation strategies.

The report shows that decision makers credit DX for unlocking the benefits of transparency and tax compliance. By embracing DX, businesses can demonstrate responsible fiscal management.

At the same time, they can position themselves as leaders in tax transparency. In doing so, companies are nurturing stronger relationships with regulators and tax authorities which improves their reputation. Such milestones support their ESG strategies.

Delivering on the global push for tax transparency through DX is not just a means for achieving optimised compliance. Overall, tax transparency provides a pathway to a more reputable future for the future of business and its contribution to society.

Thomson Reuters’ DX in Tax Compliance and Statutory Reporting 2023 Survey Report features the insights you need to secure your organisation’s future in innovation. Download your copy of Part one: Macro Trends Driving Tech Adoption in Tax and Finance today.