In recent years, financial services firms have adopted technological solutions at a great clip, however, last year’s tumultuous macroeconomic environment and challenging regulatory landscape has altered firms’ perception.

The newly published seventh report on Fintech, RegTech, and the role of compliance in 2023, produced by Thomson Reuters Regulatory Intelligence (TRRI), gives at times a contrasting message on the status of the fintech marketplace.

On one hand, survey respondents identified an increasingly diverse range of uses for financial technology (fintech) and regulatory technology (regtech) applications, ranging from credit risk analysis, where 40% of global systemically important banks (G-SIBs) were using fintech applications, to information security, where 30% of respondents reported using fintech solutions.

On the other hand, there are signs of a slowdown in the growth of the fintech sector. In the first half of 2022, for example, the total capital invested in fintech worldwide reached $59 billion, which was flat year-over-year, according to Innovate/Finance’s 2022 Summer Investment Report. What’s more, there were 3,045 deals completed in the fintech sector, fewer than the 3,401 deals in the first half of 2021.

The slowdown is echoed in the findings from this year’s TRRI survey. There was a fall in the number people feeling extremely positive about fintech and regtech. For fintech overall, this year’s survey reported that 15% of respondents were extremely positive compared with 31% last year. For regtech, 15% of respondents felt extremely positive compared with 26% in 2021. What’s more, less than one-in-ten (8%) of respondents from G-SIBs felt extremely positive about fintech.

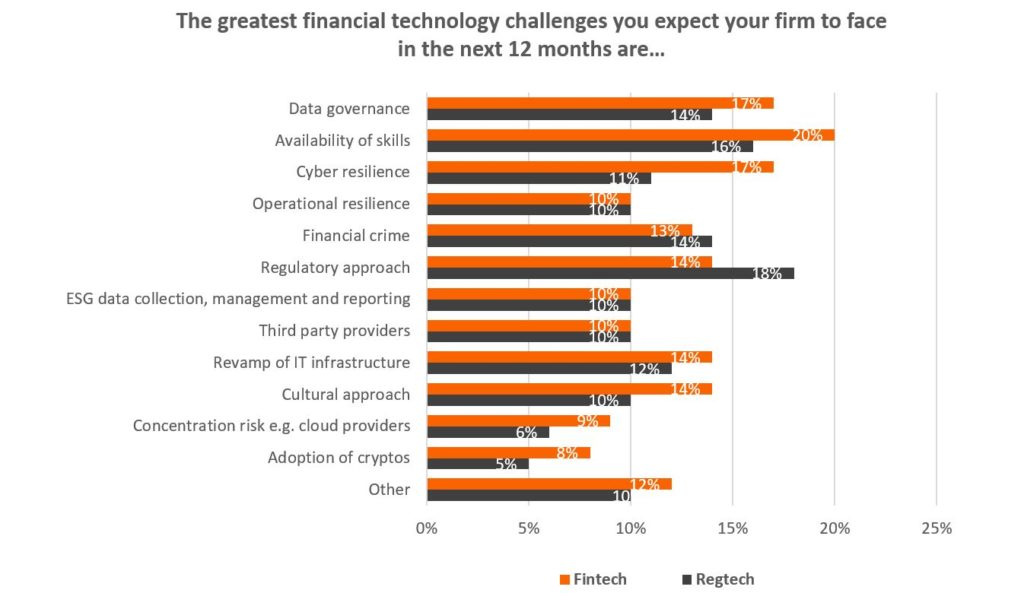

It may be unsurprising that respondents felt less positive about innovation and digital disruption given the challenges that firms must address across the board. This year, respondents said that the availability of skills (20% fintech, 16% regtech) and regulatory approach (14% fintech, 18% regtech) were the most significant challenges anticipated in the next 12 months. For G-SIBs, concentration risk and third-party providers ranked highest among challenges for fintech (15%), whereas cultural approach (15%) was the biggest challenge facing G-SIB regtech users. Data governance and cyber resilience also feature highly in the list, with other areas including financial crime and operational resilience also prominent.

Regulators are also adopting technological solutions to help with their supervisory roles and the management of large volumes of data. That means, firms need more interaction with regulators on fintech and regtech. More than two-fifths (43%) of G-SIBs reported having spoken to their regulator about fintech and regtech. This contrasts with responses from other financial services firms, nearly 60% of which reported that their regulator had not spoken to them about the use of technological solutions.

Despite this current slowdown and waning of enthusiasm, the future of the fintech market remains optimistic, the report observes, recommending that financial services firms should continue to invest in technology, IT infrastructure, and associated skillsets. To maximize the potential of technological innovation, firms must continually reassess their technological needs and then invest in solutions tailored to the activities of their business.

The Fintech, Regtech, and the role of compliance survey has, in its lifetime, attracted more than 3,000 respondents. Participants from all sectors of financial services — from globally significant banks to technology start-ups — took part in this seventh survey. The survey results are intended to help financial services firms with planning, resourcing, and direction, allowing them to benchmark whether their approach, skills, strategy, and expectations are in line with those of the wider industry. The report specifically focuses on areas that directly affect the compliance function.

The report also assesses the extent to which firms are turning the technological challenges they are now facing into opportunities, embracing new ways of working and navigating the evolving regulatory approach.

Download your complimentary copy of TRRI’s 7th report on Fintech, RegTech, and the role of compliance in 2023, by completing the form on this page.

This article was originally published on the Thomson Reuters Institute and features on Legal Insight with permission.