The G7’s announcement regarding a potential exemption for some US-based multinationals from certain aspects of Pillar Two has made waves, but what does it mean for large multinationals headquartered in…

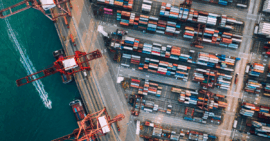

Read moreMastering tariff series Part 4: Ensure classification compliance

This is the fourth in a series of blog posts examining product solutions that can help specialists and strategists master tariff compliance.

Read moreMastering tariff series Part 3: How to capture duty savings

This is the third in a series of blog posts examining product solutions that can help specialists and strategists master tariff compliance. In the previous posts, we explored how ONESOURCE…

Read moreMastering tariff compliance series Part 2: Avoiding or delaying tariffs

As companies deal with the new global environment of tariffs from and to the United States (U.S.), they’re desperately seeking ways to protect their bottom lines. One significant way they can do that is through a foreign trade zone (FTZ).

Read moreMastering tariff compliance series Part 1: Minimising the impact of tariffs

President Donald Trump’s levying of tariffs is creating massive uncertainty for companies that do business in or with the United States. The inability to know how things will progress makes it extremely difficult to put strategies in place to mitigate or avoid adverse impacts.

Read morePillar Two: Where is it going as of July 2025?

Two of the mechanisms within the Pillar Two rules brought relief for some and uncertainty for many following a recent update. Learn more.

Read moreE-invoicing in UAE: How to prepare for July 2026

Businesses across the UAE are gearing up for the transition to mandatory e-invoicing in July 2026. Mandatory e-invoicing will standardise invoicing compliance for Business-to-Business (B2B) and Business-to-Government (B2G) transactions. Are…

Read moreDuring the tariff wars: Keep responsible AI in focus

We are currently riding a rollercoaster of new U.S. tariffs and retaliatory measures, which is stirring up an avalanche of uncertainty for global enterprises. Having already faced U.S. tariff hikes…

Read morePresident Trump’s tariffs: What tax and accounting professionals should know

The Trump administration made headlines with its imposition of additional tariffs on goods from various countries, including China, Mexico, and Canada. These tariffs, essentially taxes on imported goods, sent ripples…

Read moreTrump reciprocal tariff threats rock global trade

Tariffs have been a target for reform since U.S. President Donald Trump took office earlier this year.

Read more