The G7’s announcement regarding a potential exemption for some US-based multinationals from certain aspects of Pillar Two has made waves, but what does it mean for large multinationals headquartered in…

Read morePosts by Thomson Reuters

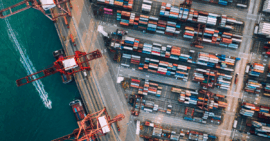

Mastering tariff series Part 4: Ensure classification compliance

This is the fourth in a series of blog posts examining product solutions that can help specialists and strategists master tariff compliance.

Read moreMastering tariff series Part 3: How to capture duty savings

This is the third in a series of blog posts examining product solutions that can help specialists and strategists master tariff compliance. In the previous posts, we explored how ONESOURCE…

Read moreMastering tariff compliance series Part 2: Avoiding or delaying tariffs

As companies deal with the new global environment of tariffs from and to the United States (U.S.), they’re desperately seeking ways to protect their bottom lines. One significant way they can do that is through a foreign trade zone (FTZ).

Read moreMastering tariff compliance series Part 1: Minimising the impact of tariffs

President Donald Trump’s levying of tariffs is creating massive uncertainty for companies that do business in or with the United States. The inability to know how things will progress makes it extremely difficult to put strategies in place to mitigate or avoid adverse impacts.

Read morePillar Two: Where is it going as of July 2025?

Two of the mechanisms within the Pillar Two rules brought relief for some and uncertainty for many following a recent update. Learn more.

Read moreFuture of Professionals Report 2025 – Thomson Reuters

Thomson Reuters has published the third edition of its Future of Professionals Report, drawing on insights from a global online survey of 2,275 professionals. The 2025 edition explores key themes…

Read moreE-invoicing in UAE: How to prepare for July 2026

Businesses across the UAE are gearing up for the transition to mandatory e-invoicing in July 2026. Mandatory e-invoicing will standardise invoicing compliance for Business-to-Business (B2B) and Business-to-Government (B2G) transactions. Are…

Read moreUsing AI in Professional Services: 2025 and Beyond

More and more, professionals are weaving generative AI (GenAI) into their workflows and are increasingly optimistic about its benefits. As AI use becomes more widespread, the focus has shifted from whether…

Read more2025 Tariffs survey: How to thrive in a volatile environment for global trade

A new report shows that the current volatile environment surrounding tariffs and global trade has many trade professionals clearly concerned and looking for ways to mitigate costs, diversify supply chains,…

Read more