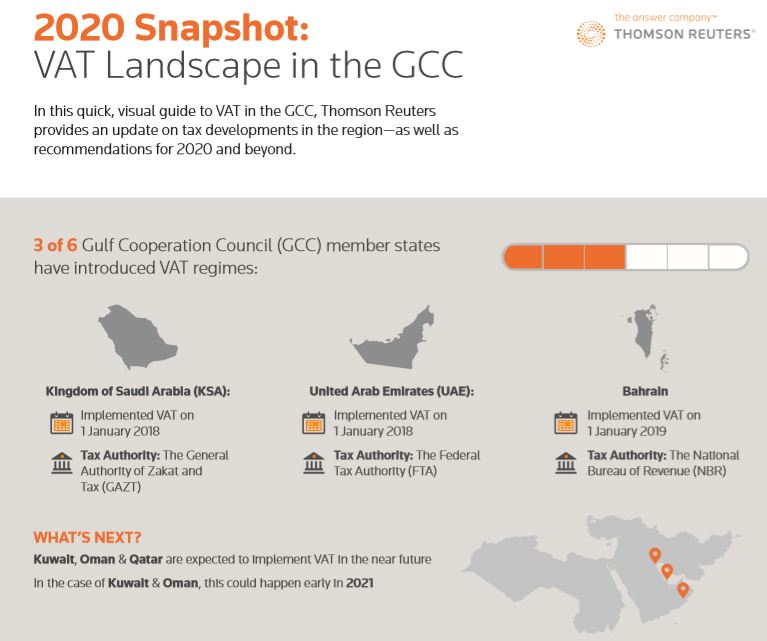

Since the introduction of VAT, the GCC region has undergone a transformation in their economic and financial landscape. Companies in UAE, Saudi Arabia and Bahrain have adapted to the realities of the new VAT regime, and many are realizing that their systems are not set up for efficient, accurate VAT compliance and reporting.

Whereas, Oman, Qatar and Kuwait are preparing to transition into their VAT regimes during 2021. Businesses in these countries are recommended to start their VAT impact assessments at least 6 months before the implementation, and be sure that their people, processes (e.g. legal, operations, commercials, Human Resources) and systems are ready in time to meet day-to-day tax compliance obligations.

In this infographic, Thomson Reuters provides a quick summary of each country and where they are on their VAT journey; touches on lessons learned; and then focuses on how technology can help businesses to either get ready for the introduction of VAT or streamline their VAT compliance processes to ensure compliance in an increasingly digital tax environment.