The coronavirus pandemic is an unprecedented challenge on a global scale. In just a few short months, the COVID-19 outbreak has disrupted trade, brought the travel industry to its knees and wiped trillions of dollars from stock markets worldwide.

All over the world, containment measures are crippling production and spending, with a momentous economic impact. According to the United Nations’ trade and development agency, the novel coronavirus could cost the world economy at least $1 trillion.[1]

In India, as in many emerging markets, the economic fallout could outlast the health crisis itself. Barclays predicts that India’s 21-day lockdown alone could reduce GDP growth to 2.5 percent – down from its earlier estimate of 4.5 percent.[2]

India’s corporate community will need to put sound business continuity plans in place to endure a pandemic of this scale, especially when so many organizations are having to suspend or limit operations during the lockdown period while still paying wages, taxes, electricity and other expenses.

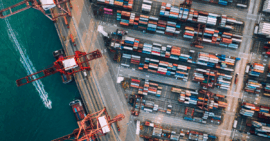

Impact on trade flow

As the major economies of the world gear down dramatically, this has a great impact on Indian enterprises that trade with the US, UAE, Germany, UK, Singapore, Italy and China, among others. The spread of the virus has led to a drop in demand, as well as border closures, restricted cargo movement, a lack of warehousing capacity and stalled export finance. International shipping lines and air routes are blocked, disrupting supply chains and creating unparalleled challenges for businesses engaged in global trade.

Furthermore, if China moves into a recovery phase as the rest of the world still grapples with the virus, China could be in a stronger position to meet the global post-pandemic demand than India. GOVERNMENT INITIATIVES

This is a fast-developing situation and a lot can change from day to day. Outlined below is a brief overview of the measures that the various governments on the continent have put into place.

Due to the government’s rapid implementation of quarantine measures, Universal Health Screening at airports and border closures, the COVID-19 infection rate in India is currently relatively low compared to population size, although it is too early to rule out the possibility of a broader outbreak.[3]

To support the most vulnerable parties during the lockdown period, Finance Minister Nirmala Sitharaman has announced an economic stimulus package worth 1.7 trillion rupees ($22.5 billion), focused on food security measures for low-income households and financial support for daily wage earners and small business owners.[4]

Additionally, the following relief measures have been announced:[5]

Income Tax

- Return submission: The income tax return deadline for the 2018-2019 tax year has been extended from 31 March 2020 to 30 June 2020.

- Reduction of interest rate: The interest rate for delayed payments of advanced tax, self-assessment tax, regular tax, Tax Deducted at Source (TDS), Tax Collected at source (TCS), equalization levy, STT and CTT made between 20 March 2020 and 30 June 2020 has been reduced to 9% (from 12%/18% per annum). No late fee/penalty will be charged for this period.

- Other: Deadlines expiring between 20 March 2020 and 29 June 2020 are extended to 30 June 2020 – pertaining to: the issue of notice, intimation, notification, approval order, sanction order, filing of appeal, furnishing of returns, statements, applications, reports, and any other documents and time limits for the completion of proceedings by the authority and any compliance by the taxpayer under the Income Tax Act, the Wealth Tax Act, the Prohibition of Benami Property Transaction Act, the Black Money Act, the STT Law, the CTT Law, the Equalization Levy Law and the Vivad Se Vishwas Law.

GST/Indirect Tax

- GSTR-3B return submission for small and medium businesses (SMEs): The GSTR-3B filing deadlines for March, April and May 2020 have been extended to 30 June 2020 for SMEs (taxpayers with an aggregate annual turnover below INR 50 million).

- Note: No interest, late fee or penalty shall be charged.

- GSTR-3B return submission for large taxpayers: Other taxpayers may also be eligible for the above, subject to interest at a rate of 9% per annum from 15 days after due date (reduced from 18%).

- GSTR-4 return submission and payment for composition dealers: The deadline for opting for the composition scheme is extended to the last week of June 2020. Additionally, for composition dealers, the deadline for making payments for the quarter ending 31 March and for filing the return for 2019-20 is extended to the last week of June 2020.

- Annual return (GSTR-9) submission: The GST annual return filing deadline for FY 18-19 is extended from 31 March 2020 to 30 June 2020.

- Extension of other deadlines: Deadlines expiring between 20 March 2020 and 29 June 2020 are extended to 30 June 2020 – pertaining to: the issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, and any other documents and time limits for any compliance under GST Law.

Customs

- Customs clearance 24*7 hours: In order to support businesses engaged in trade and mitigate the impact on imports and exports, where possible, customs clearance has been declared an essential service that will operate 24 hours a day, 7 days a week until 30 June 2020.

- Extension of deadlines: Where the time limit for any compliance under the Customs Act and other allied laws expires between 20 March 2020 and 29 June 2020, this will be extended to 30 June 2020.

Corporate Affairs

- No fees for late filing of documents as per MCA-21 Registry: A moratorium period has been implemented from 1 April 2020 to 30 September 2020, during which no additional fees shall be charged for late filing of any document, return, statement, etc. in the MCA-21 Registry, irrespective of its due date.

- Extension of due date of Board meetings: The mandatory requirement to hold Board meetings within prescribed interval provided in the Companies Act, 2013 (120 days), shall be extended by a period of 60 days until 30 September 2020.

- Extension of applicability of CARO, 2020: The Applicability of Companies (Auditor’s Report) Order, 2020 shall be made applicable from the financial year 2020-2021 rather than 2019-2020, to alleviate the burden on companies and their auditors.

- Extension of deadlines of reserve: The deadline for creating a reserve of 20% of deposits maturing during the financial year 2020-21 has been extended from 30 April 2020 to 30 June 2020. The same extension applies to the requirement to invest 15% of debentures maturing during a particular year in specified instruments.

WHAT CAN YOUR BUSINESS DO?

While these interventions will provide some businesses with a certain level of support, the road ahead will still be a challenging one for many organizations. It’s therefore essential for all companies impacted by the pandemic to take action now and develop a continuity plan for the months ahead.

Essentially, your business needs the tools and technologies to stay agile, manage fast-changing regulations and rules, and control risk.

- Is your company ready for remote work? Where operationally relevant, making sure every employee has the IT assets and support required to work from home – both during and after lockdown periods – is an essential aspect of any COVID-19 business contingency plan. Solutions that facilitate team communication, data accessibility and digital workflow management are ideal in this environment.

- Improve supply chain communication and monitoring As you adapt to new trading challenges, you may want tools to communicate with your regional and global business partners in various languages, and monitor supply chain risk more comprehensively. An automated solution can provide electronic collection, standardization and organization of business partner information, with workflow tools that allow you to digitally route assessments, requests and reminders to the relevant stakeholders.

- Manage exports more efficiently As export rules change, you need to confidently maintain export control classifications for products and generate accurate documentation. An export management solution can reduce your risk of non-compliance, while making clearance, screening and document creation processes more efficient.

- Gain complete control over imports A purpose-built import solution can help you to securely exchange the trade data required for the importation of goods into any country around the world, from purchase order to final delivery. With a complete, automated system for consolidating the necessary information for import filing – and the tools to validate that data against current regulatory content – you can optimize efficiency in your supply chain.

- Know who you’re doing business with In turbulent times, it’s critical to continue protecting your business against risk that could be hiding in your business relationships – especially if you’re planning to adapt your trade lanes. You need a trusted solution for screening potential and existing business relationships against current global lists for restricted persons, companies, and sanctioned or embargoed countries.

THE WAY FORWARD

We can help you to address the unique challenges on the path ahead and steer your business through this volatile environment during 2020 and beyond.