Corporate law and tax professionals as well as their outside firms believe generative AI tools like ChatGPT can and should be used for work; but the sectors differ in potential use cases and how they’re approaching risk mitigation policies

As generative AI tools such as ChatGPT continue to take hold in the public consciousness, those in the legal and tax professions are beginning to consider and plan for how these innovative technologies could be used in their own work and how to overcome the risks that generative AI presents.

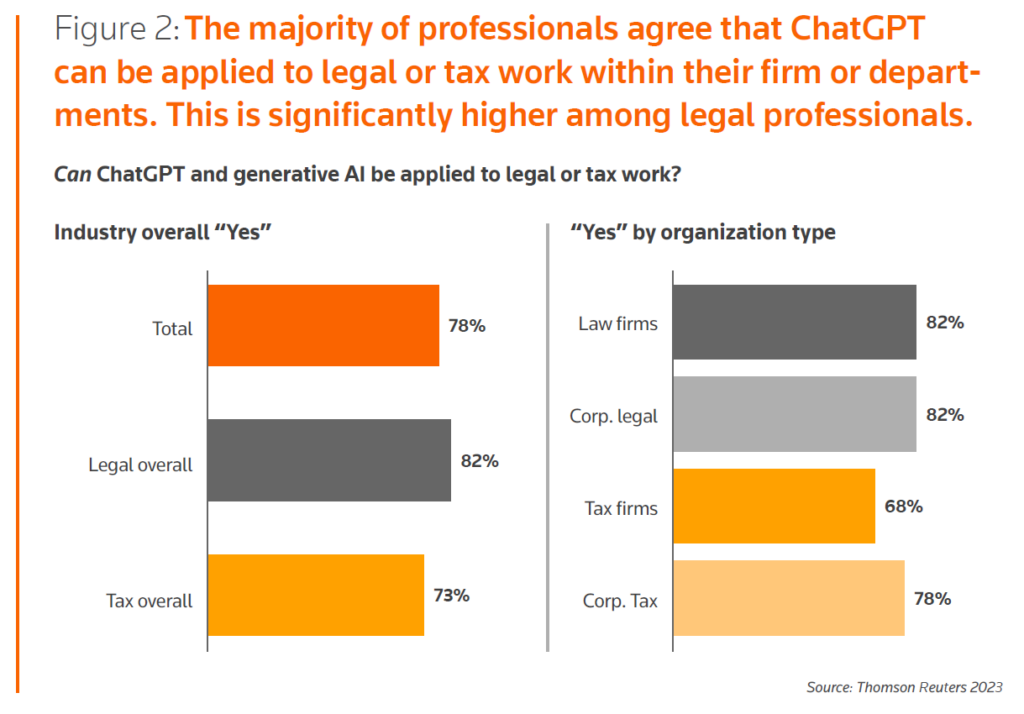

A new report comparing legal and tax approaches to generative AI, as well as the difference between corporate and outside professionals, reveals how attitudes and adoption of generative AI are developing in the tool’s early days. Although there are some slight differences in the strength of their opinions — for example, more legal professionals than tax professionals believe generative AI can be applied to their work — respondents from all segments said they feel positively that the technology can apply to their daily work product.

The Future of Professionals: ChatGPT and Generative AI in Legal, Corporate & Tax Markets report comes from a series of surveys conducted between March and May by the Thomson Reuters Institute of more than 1,800 legal and tax professionals in the United States, the United Kingdom, and Canada. The survey was accompanied with assorted interviews conducted by the Institute, painting a picture of professional services industries that are still weighing their options for adopting the technology even as they eye potential use cases for when they feel the technology is ready.

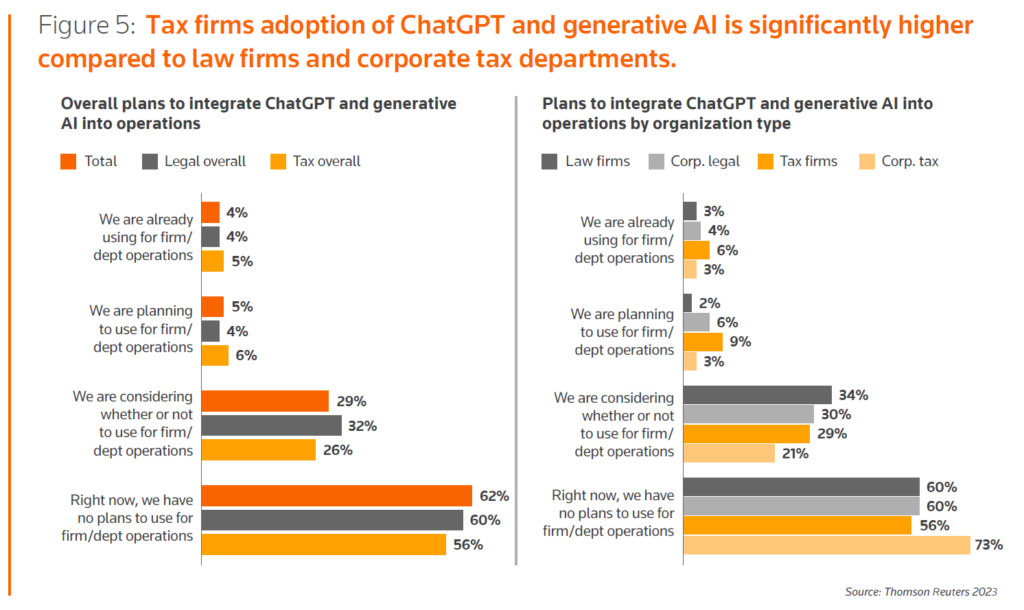

Some segments are already moving: 15% of tax & accounting firm respondents and 10% of corporate law department respondents, for instance, report already adopting generative AI tools or having made clear plans to do so. Others are still waiting out the technology, however: respondents from 73% of corporate tax departments said they have no plans to adopt generative AI technologies at this time, 13 percentage points higher than any other segment.

Other important findings in the report include:

- Most respondents said they feel these technologies can and should be used for work — More than three-quarters (78%) of respondents believe ChatGPT or generative AI can be used for legal or tax work, and about half (52%) of all respondents believe that it should be used. Corporate law and corporate tax departments answered affirmatively at a slightly higher rate — 3 to 4 percentage points higher — than their outside law firm and tax & accounting firm counterparts.

- Many are still considering potential adoption — Despite strong feelings about the tools’ potential utility, many within the legal and tax professions are still weighing their options before actually adopting the technology. Just 4% of all respondents said they were already using generative AI or ChatGPT for firm or department operations, and 5% said they were actively making plans to do so. Those numbers were largely consistent across geographies and the type of practice, although tax & accounting firms in particular had a higher rate of adoption or planned adoption (15%) than other types of respondents.

- A focus on risk — More than two-thirds (69%) of respondents said their organization has risk concerns around the use of generative AI or ChatGPT, while just 8% said their organization did not have risk concerns. Almost one-fourth (23%) said they did not know. Despite these warnings, however, very few organizations are taking active steps to limit generative AI or ChatGPT usage: Just 20% of respondents said their firm or company has warned employees against unauthorized generative AI or ChatGPT usage, and 9% of all respondents said their organization had banned the unauthorized use of generative AI or ChatGPT.

There is a distinct potential for this technology to change not only how legal and tax professionals work on a daily basis, but how corporate departments interact with their outside firms. As Wei Zhao, General Counsel of Segway, noted: “I think this technology has the potential to replace a lot of entry-level lawyers and allow far fewer lawyers to get the same amount of work done.”

You can download a copy of the Thomson Reuters Institute’s new report by completing the form above.

This report was originally published on the Thomson Reuters Institute, and has been republished here with permission.