Don’t miss your chance to benchmark your experience against 100s of risk & compliance practitioners!

Be part of our next annual Fintech, Regtech and the Role of Compliance survey.

Thomson Reuters is excited to announce the launch of our 6thannual Fintech, Regtech and the Role of Compliance survey. 2020/21 has seen significant digital transformation and acceleration to meet the challenges of the COVID-19 pandemic. By necessity and by design firms have implemented the roll-out of technology, often at speed, to enable business activities to continue as countries went into lockdown.

Our survey should take no longer than 5 minutes to complete and you will receive a copy of the report once it is published. All information will be treated in the strictest confidence and the results will be shared anonymously through a special report which will be available by the end of 2021. The survey will close on 13th August 2021.

Thank you in advance for your time and valuable input.

Digital transformation and technological innovation have taken a leap forward during the pandemic with financial services firms adopting new ways of working supported by emerging iterations of fintech, regtech and insurtech. That said, a balance must be struck, however, to ensure the benefits are not outweighed by the risks. The implementation of fintech, regtech and insurtech, together with the oversight of suptech, must not take place at the expense of either good customer outcomes or continuing financial stability.

The business impact of COVID-19 has made firms think about what regtech can, cannot or should not do for them. They will increasingly need to flex their approach to deal with limited budgets and there is no ‘one solution fits all’. There has been a huge leap forward in the adoption of technology and the associated digital transformation but there is still much that technology could deliver. Improved efficiency and speed is essential if firms are to be able to deliver more with less and achieve the required cost savings. An inherent part of accurate data analysis is the need to be able to trust the output from technology, and indeed to trust that data sufficiently to use it as a base for strategic decision-making.

Regulators have been working with the industry through sandbox initiatives, questionnaires, and consultations to establish best practice for the emerging or enabling technologies. As the industry develops, firms have an opportunity to be creative and direct software houses to areas of the financial services industry in need of automation, such as financial inclusion and regtech. They also have the chance to shape regulators’ views on fintech and to create a regulatory structure that benefits all.

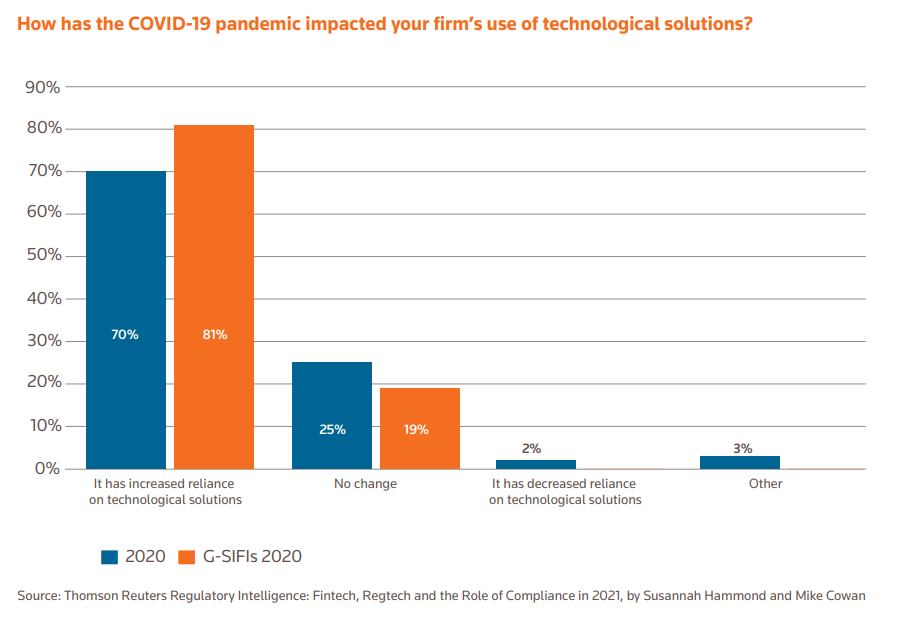

The report for 2021 highlighted, in addition, to an increased reliance on technological solutions as a result of the pandemic, continued investment in specialist skills for the risk and compliance function, greater confidence in firms’ IT infrastructure to be able to support fintech solutions together with differing budget expectations for regtech solutions.

The Thomson Reuters Regulatory Intelligence survey results and accompanying report for 2022 will provide insight into both the developing global regulatory approach and the direction and progress of risk and compliance functions in managing fintech, regtech and insurtech, enabling firms to benchmark their own views and preparations against peers. Individual fintech, regtech, insurtech and suptech solutions are not considered but rather the key points for firms and boards together with their risk and compliance functions to take into account when considering the deployment and use of possible technology-enabled solutions.

The survey should take no longer than 10 minutes to complete. All information will be treated in the strictest confidence and the results will be shared anonymously through a special report which will be available by the end of 2021. The survey will close on 13th August 2021.