Unlocking the Chain is a series providing firms in Asia with tips and knowledge to reduce supply chain risks and costs by sourcing and supplying within the region’s network of hundreds of FTAs and leverage technology that optimizes their production, customs duties and trading networks

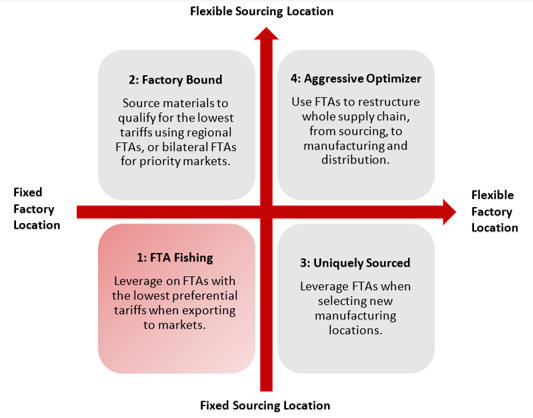

The last piece outlined four scenarios for firms, shown in Figure 1. Each quadrant of the scenarios gives a different set of opportunities and challenges for companies to consider. Today’s piece looks more carefully at Scenario 1: FTA Fishing.

Many firms may be enthusiastic about the idea of harnessing FTAs to drive growth, but unable or unwilling to shift the existing supply chain footprint by moving sourcing or factory locations.

It may seem, in fact, that looking for benefits from FTAs is a meaningless exercise if the firm will be operating the same way as before. However, firms that have not examined the potential gains to be had from using FTAs may be unaware that the company is spending too much on tariffs—even within the existing supply chain footprint.

Why would a firm not be harnessing FTAs if these provide cost savings and greater certainty? Often because companies are simply unaware of the benefits of doing so, or because the firm’s distributed internal structure has not made it anyone’s priority to try. Companies that do not effectively harness technology can also struggle to understand the current cost structures or to map today’s footprint against potential FTA benefits.

Example: Peach Jam from Thailand

To see what an FTA Fishing strategy might look like, consider the manufacturing of peach jam by a Thai diversified food company that intends to export to Australia, Canada, the European Union, Japan and the United States. It uses peaches sourced from China and produces jam in a factory located in Thailand.

The firm will ideally locate its production and sourcing to qualify for preferential tariffs for the highest number of actual and potential markets. But for today’s example, the firm is not interested in switching suppliers or moving manufacturing out of Thailand.

Table 1 below illustrates both the existing tariff rates for peach jam into all five final markets. Jam, like many food items, is often subject to high MFN tariff rates. (MFN rates are imposed on all products crossing the border that are not eligible for benefits or preferences under existing FTAs.)

| End Market | MFN Tariff Rates |

| Australia | 5% |

| Canada | 12.5% |

| EU | 24% |

| Japan | 16.8% |

| USA | 7% |

Why FTA Fishing Makes a Bottom Line Difference

Assume that the cost of the peaches make up at least 40% of the dollar value of the final product, and there are no tariffs for exporting peaches from China to ASEAN countries.

The peaches are imported from China to the jam factory in Thailand, where the peaches are chopped and then blended with sugar and pectin. The jam is cooked, pasteurized and packaged in jars for export.

Australia’s standard rate for WTO members, the Most-Favoured Nation (MFN) tariff rate, for peach jam imports is 5%. Therefore, for every $1 of peach jam sold, the company pays 5 cents in import tariffs (which may be passed on to customers as higher prices).

The company is unable to easily relocate its factory or its peach supplier’s source country. However, it can search for FTAs to reduce its preferential tariffs. Thai jam qualifies for 0% preferential tariff rates in the ASEAN-Australia-New Zealand FTA (AANZFTA). As the manufacturing process results in a change of tariff heading in the originating materials, it qualifies for the AANZFTA’s 0% rate, resulting in a cost saving of 5 cents on the dollar in tariffs for export to Australia.

Do note that the company will need to ensure that it complies with the rules of origin (ROOs) that accompany peach jam to qualify for these lower tariff rates.

The peach jam firm has managed to save money on exports to Australia. It could also save money into Japan, by using the ASEAN-Japan FTA. However, the ROOs under ASEAN-Japan do not allow the use of peaches from China. Hence, jam under the existing supply chain footprint is not eligible for preferential tariff reductions.

Unfortunately for the jam firm, it is not possible to use an FTA to save on MFN tariff rates into Canada, the EU or the United States at this time, as there are no FTAs to link Thailand to these final markets. Trade agreements can only be used between members.

While the peach jam firm has only managed to save tariffs into Australia using FTA Fishing, other companies may find greater success with their products, as tariff reductions vary between FTAs.

How technology can support firms assess their existing supply chain footprint

Firms can often struggle just knowing the tariff rates they must pay for their products going into foreign markets. Information can be published by a variety of sources, without clear indication of what can be truly relied upon. Global Trade Management software supports firms by aggregating global trade content from official sources, ensuring that it is current, validated and available in a centralized database for ease in determining duty rates, free trade agreement opportunities and the rules of origin that apply to their products.